cheaper car risks affordable car insurance insurance affordable

cheaper car risks affordable car insurance insurance affordable

While the amount of your insurance deductible can elevate or reduce your costs, deductible as well as costs are 2 various things. The called guaranteed on the policy is liable for paying the insurance deductible amount.

automobile car risks business insurance

automobile car risks business insurance

It's not the very same as a health insurance deductible. As with all things insurance coverage, it's ideal to discuss deductibles and how they apply in your scenario with a regional independent insurance representative. Your regional independent agent has the knowledge and experience to respond to often asked concerns concerning deductibles and also calculate expense financial savings for you depending on the deducible quantity you choose.

If you utilize the common mileage rate, you can not deduct automobile insurance coverage costs as a separate expenditure (credit score). Nevertheless, you can still subtract tolls as well as vehicle parking costs (auto). This consists of car insurance policy and also the various other items detailed above. If you're unsure which one you intend to utilize, or which might let you subtract extra, it might help to review the gas mileage deduction rules.

Car Insurance Deductibles Explained - Progressive for Dummies

Many people make use of a personal cars and truck for both personal as well as business functions. To find out what uses to your taxes, you'll separate the expenses between individual and business usage based on the miles that you drive - affordable auto insurance. If 70% of the miles you drive are for organization, as well as the various other 30% are for personal, you'll generally be able to use 70% of your expenditures to your reduction - trucks.

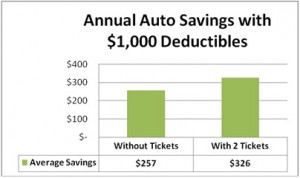

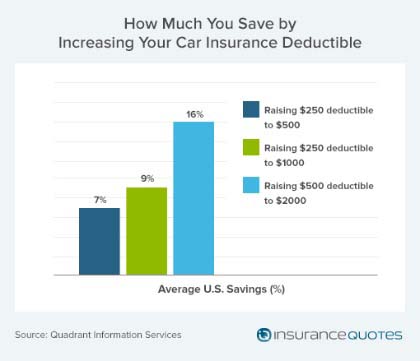

Deductibles could be a standard part of cars and truck insurance coverage plans, however that does not imply everyone understands how they work. In fact, lots of motorists aren't familiar with just how your deductible amount Website link effects just how much you spend for cars and truck insurance (affordable auto insurance). If you desire one of the most budget friendly auto insurance coverage, choosing a greater insurance deductible is one method to keep your regular monthly insurance policy payments low and also remain covered, however it's not the most effective option for each driver.

Keep scrolling to find out exactly how vehicle insurance deductibles work as well as exactly how to choose the right insurance deductible amount for you, plus just how readjusting your insurance deductible could aid you lower your month-to-month auto insurance policy settlement. What is a car insurance policy deductible? An insurance deductible is a set quantity of money that you have to pay in advance and out of pocket when filing a covered claim before your insurance kicks in to help cover the remainder of the problems.

To find out more concerning vehicle insurance coverage deductibles or a cost-free quote on economical insurance coverage, phone call 1-877-GO-DIRECT (1-877-463-4732) or visit a Direct place near you!.?.!! * Repayment strategies undergo conditions and also might not be available in all areas. Cost may differ based upon just how you acquire - cheapest. Not all products, discount rates, or pay plans are readily available in all states.

4 Simple Techniques For Diminishing Deductible - Elephant Insurance

The vehicle insurance deductible is the amount of cash you will first be responsible for prior to the insurer starts to cover prices. Unlike health insurance policy, car insurance coverage plan deductibles are generally on a per case basis meaning you would certainly need to cover these prices every time you submit an insurance claim. insurance company.

insurers credit score insure cheaper cars

insurers credit score insure cheaper cars

Just how does the insurance deductible work? Your deductible, commonly around $750 will certainly be first used to any kind of problems. insurance companies.

The continuing to be $2,750 would then be covered with the accident insurance coverage by your insurance provider - cheap. Sometimes where another vehicle driver is at mistake for the crash you might want to file a third-party claim against their Under these conditions your insurer may pursue a procedure called subrogation to redeem the amounts they have actually currently paid.

You can discover more in our short article on? Selecting the ideal auto insurance coverage deductible quantity Your first factor to consider when choosing your insurance coverage deductible is just how much you would be able to pay in the occasion of an incident - business insurance. market you protection for a revenue, the even more threat security you get the more they profit as well as the reduced your deductible the even more risk protection you are getting.

The Buzz on What Is A Disappearing Deductible? - Mapfre Insurance

perks cheaper insurers risks

perks cheaper insurers risks

It is also crucial to keep in mind that since auto insurance deductibles are on a per-claim basis so the frequency of your insurance claims will certainly be among one of the most essential aspects - accident. If your policy has a $500 insurance deductible and you were involved in 4 separate cases of less than $500, after that you would be in charge of 100% of all the settlements and your insurance would certainly have supplied no insurance coverage (vehicle insurance).

One approach you can take is to take a look at your driving and also car background. If your history indicates that you may require to make more frequent insurance claims, you may wish to take into consideration selecting a plan with lower out of pocket costs. On the various other hand, if you haven't had a history of crashes you may not need a low deductible plan.

When it pertains to vehicle insurance policy, a deductible is the amount you would certainly need to pay out of pocket after a protected loss prior to your insurance policy coverage begins. Vehicle insurance deductibles work differently than medical insurance coverage deductibles with car insurance, not all types of protection need an insurance deductible. Responsibility insurance policy doesn't need a deductible, but extensive as well as crash insurance coverage typically do. cars.